ABOUT VIVA

Viva is a new decentralized home loan financing platform. More specifically, the platform is designed as a mortgage and crowdlending platform that runs directly on blockchain technology. If you go to the company website, then you can contribute or learn more about the system through reading the white book.

The Viva platform will use smart contracts for a crowdfund home loan, connecting borrowers and direct investors in a decentralized decentralized ecosystem. Utilizing ultra-secure blockchain transactions, Viva cuts intermediaries, resulting in a more lucrative and efficient lending process for all. Viva allows the free market to determine the interest rate on the borrower's mortgage and eliminates the need for banks and other financial intermediaries. By eliminating inefficiencies in the local financial system, mortgage interest rates will be more fair and accurate reflecting the level of risk associated with the true value of the asset.

Viva aims to revolutionize an outdated mortgage lending industry by cutting off intermediaries and decentralizing processes, thereby applying financing approaches that are fundamentally more accessible and transparent. We believe that Viva's technology will increase the availability of credit to borrowers and for the first time allow non-institutional investors to participate in consistent returns and backed by assets related to mortgage investments, products traditionally reserved solely for large financial institutions. .

Furthermore, by allowing a free market to dictate the risks and related value of each mortgage - as opposed to a bank - we expect to see a fairer mortgage. The Viva platform will be exploited by them in developed and developing countries, enabling the world to take a major step toward equality of geographic wealth - by breaking down barriers and making both parties better.

Viva's mission is to disrupt the mortgage industry by allowing buyers and home sellers to self-regulate their own terms. Every individual, from any country in the world, will have access to credit financing for home loans through a decentralized open market network on the Viva Platform.

In addition, Viva's function as an investment and savings platform accessible only by mobile means that all Viva users will have access to credit financing, savings and investment accounts, and secure transaction services supported by standard blockchain - regardless of the country in which they live.

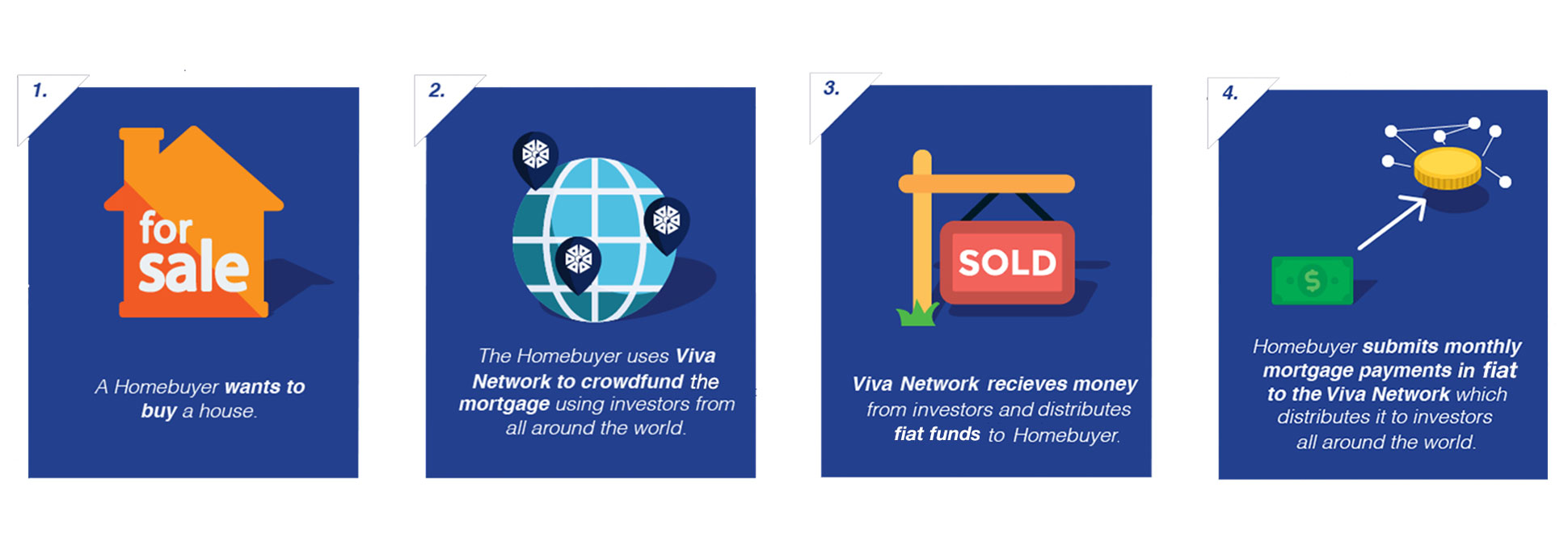

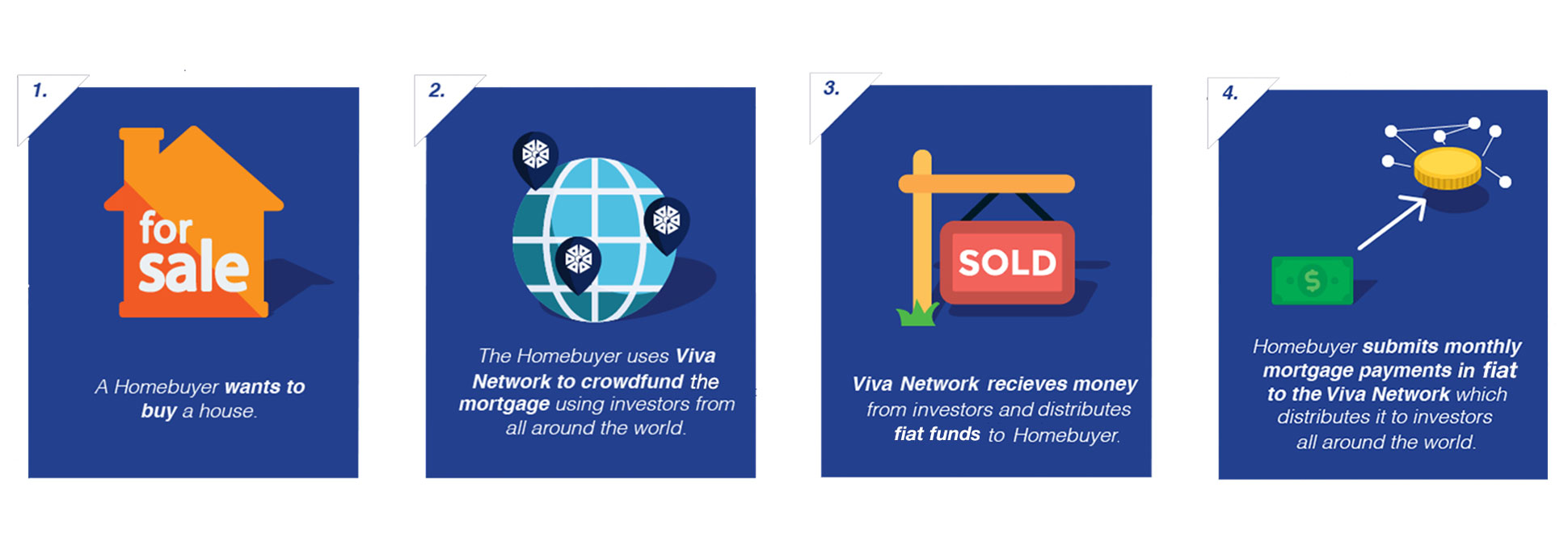

HOW TO WORK VIVA

The platform is operated by unlimited and decentralized finance companies for home loans that have been developed to eliminate the need to rely on intermediaries such as financial institutions and banks as well as financial intermediaries.

Viva will be used to create new markets in the lending / mortgage industry. The goal is to reduce the inefficiency of the industry while making it more affordable to buy a home.

This is a fist time, Viva allows private investors who are accredited to buy high-value FMS assets (Fractionalized Mortgage Shares). It also helps to innovate applications that have been designed to improve the current state and traditional credit assessment and assessment procedures, often outdated.

Viva is here to be part of the mortgage financing revolution finally here. You can contribute now on the company website. There are many different documents available for the platform, such as: whitepaper, token creation event, terms & conditions, privacy policy, and crowdlending code preview.

Innovation is Viva's key, the financial technology used on this system is deliberately used to bring a larger decentralized mortgage to the people of the world. The platform initiated smart contracts for the use of home loan financing through crowdsales. And then connect investors with p2p borrowers on a decentralized and unreliable technology platform. Utilizing unparalleled security blockchain is the key to great deals. And by cutting intermediaries like Viva, the lending process becomes more profitable than ever.

The company allows the free market to choose mortgage lending rates for borrowers. The need to own banks or other financial services intermediaries is eliminated through the process and so do local financial institutions. Mortgage rates on mortgage loans will naturally be more fair, reflecting the risks associated with it accurately in line with the true value of the asset.

When the bank failed in 2008, they brought one of the world's first cryptocurrencies and started the process of decentralizing the power of a financial conglomerate. Viva is now looking for ways to complete the process, thus taking all the powers of the older, traditional and completely outdated financing system - to leave them in the past, where they have had a very long time.

ICO DETAILS VIVA TOKEN

VIVA Token Sale is divided into two stages:

- Early Contributions

Stage This stage is performed in three rounds with different bonus amounts. - Main Contribution

Stage The main stage is done in three rounds with each bonus.

The current round is the third round (Pre-Sale) from the Initial Contribution Stage. The Pre-Sale Round in which contributors earn 35% bonus when they invest. The round will be done in 30 days or until a total of 6,870 ETH has been contributed. The exchange rate will be 46,511 VIVA for one Ether.

Event details manufacture token VIVA is as follows:

Token: VIVA

Platform: Ethereum

Type: ERC20

Price at ICO: 1 ETH = 35 714 VIVA

BONUS

Contributions Earlier,

Round 1: 40%

Round 2: 35%

Round 3: 30%

Contributions Top,

Round 1: 25%

Round 2: 15%

Round 3 (depending on investment amount):

1 to 1.9 ETH: 5%

1.9 to 2.9 ETH: 10%

2.9 to 7 ETH: 15%

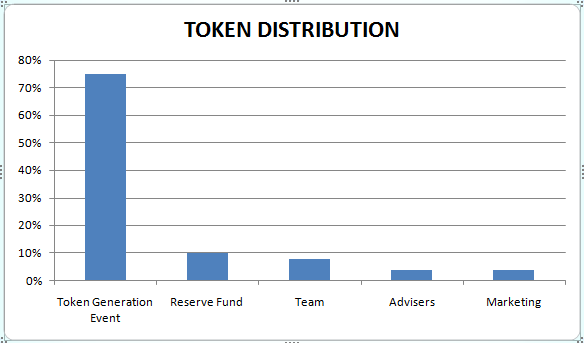

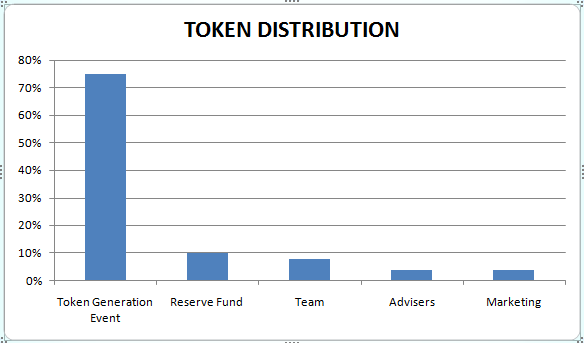

Total Token Supply : 4,000,000,000 VIVA

Tokens for sale: 3,000,000,000 VIVA

Received: ETH

Distributed in ICO: 75%

Token: VIVA

Platform: Ethereum

Type: ERC20

Price at ICO: 1 ETH = 35 714 VIVA

BONUS

Contributions Earlier,

Round 1: 40%

Round 2: 35%

Round 3: 30%

Contributions Top,

Round 1: 25%

Round 2: 15%

Round 3 (depending on investment amount):

1 to 1.9 ETH: 5%

1.9 to 2.9 ETH: 10%

2.9 to 7 ETH: 15%

Total Token Supply : 4,000,000,000 VIVA

Tokens for sale: 3,000,000,000 VIVA

Received: ETH

Distributed in ICO: 75%

KNOWLEDGE

May 2016

Development of original idea.

Development of original idea.

June 2017

Exploration of the blockchain ecosystem to identify the appropriate core technology.

Exploration of the blockchain ecosystem to identify the appropriate core technology.

July 2017

High level, service-oriented architecture planning from Viva Platform.

High level, service-oriented architecture planning from Viva Platform.

August 2017

Exploration and feasibility analysis data.

Exploration and feasibility analysis data.

November 2017

Develops Real Value 1.0 Home Appraisal Algorithm.

Develops Real Value 1.0 Home Appraisal Algorithm.

Q1 & Q2 - 2018

Launch Generation Token Events and MVP development. Start a large-scale marketing campaign.

Launch Generation Token Events and MVP development. Start a large-scale marketing campaign.

Q3 - 2018

Develop Real Value 2.0 Application. Get legal and regulatory licenses.

Develop Real Value 2.0 Application. Get legal and regulatory licenses.

Q4 - 2018

Launches the Real Value 2.0 application. Finalization of exclusive ML algorithms.

Q1 - 2019

Start the gradual launch of the Viva Network Platform.

Start the gradual launch of the Viva Network Platform.

Q2 - 2019

Launches Viva Network Platform and successfully raise the first home loan with Viva's mortgage financing system.

Launches Viva Network Platform and successfully raise the first home loan with Viva's mortgage financing system.

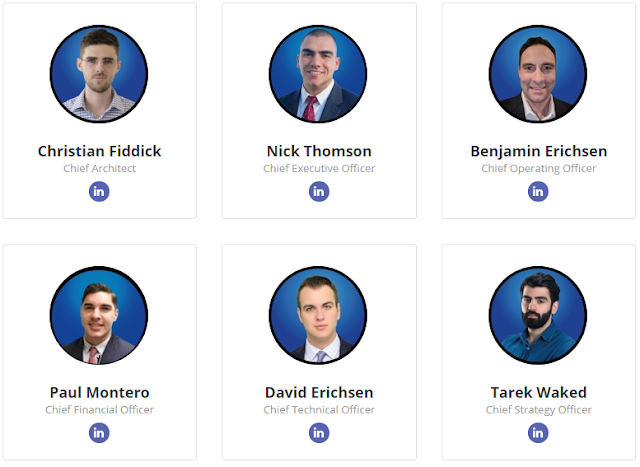

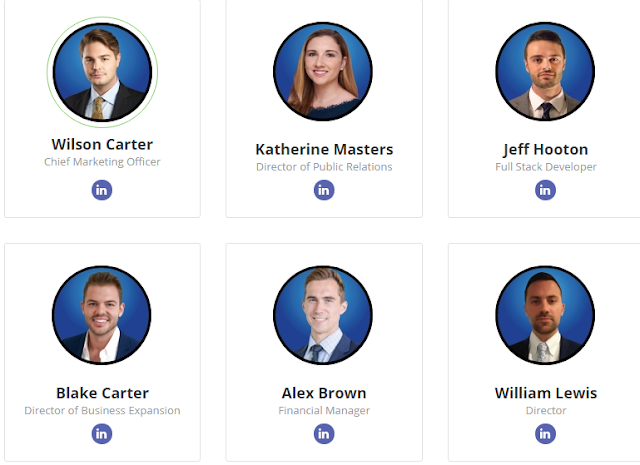

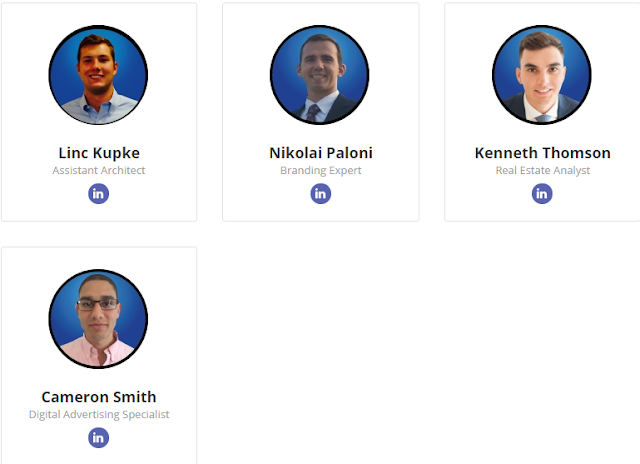

VIVA TEAM

THE ADVISORY COUNCIL

FOR MORE INFORMATION ABOUT VIVA:

- WEBSITE: http://www.vivanetwork.org/

- WHITEPAPER: http://www.vivanetwork.org/pdf/whitepaper.pdf

- ANN THREAD: https://bitcointalk.org/index.php ? topic = 3430485.0; all

- TWITTER: https://twitter.com/TheVivaNetwork

- FACEBOOK: https://www.facebook.com/VivaNetworkOfficial/

- TELEGRAM: https://t.me/Wearethevivanetwork

By:betawiarab

0x4018Fc326AfaAAf47f5042794AaaB13Ac1cd5A05

Tidak ada komentar:

Posting Komentar