What is Invox Finance?

Invox Finance is a platform that brings transparency to the concept of Invoice Financing. It's built using Blockchain technology that makes it transparent and paperless. Not only brings openness, but also comes with great features that make invoice financing less risky and more profitable for all parties involved. Let's check out the features to know more about it. if you do not mind visiting our website (https://www.invoxfinance.io/) for the latest data on our team.

System users

Investors are looking for higher returns and diversified investment portfolios.

Sellers that have invoices they want to sell to accelerate their cash flow.

Buyers who will receive an invoice payment period are updated and rewarded for verifying the invoice.

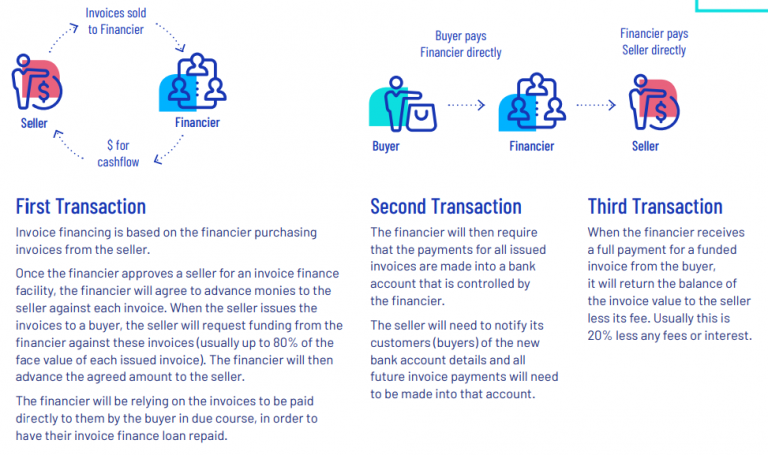

Traditional Invoicing Financing Works

As you may know that we are facing some Traditional Invoicing Financing Issues, they are:

- Traders and buyers can plan or plan together to deceive the lender.

- Merchants may issue receipts for administration that have not been fully completed or items that do not agree to an agreed determination or requirement.

- Buyers can debate installment obligations.

- There are also problems with the quality of many side procedures and include legitimate documentation. The planning and execution of authoritative archives is difficult and expensive and may include a variety of outside suppliers.

- The buyer may be destroyed and unfeasible to pay for the request.

- The merchant, in the absence of his consent with the lender, can train the buyer to pay a special request to them and not return the asset to the agent.

The main problem with traditional invoice financing is that the funder who gets the invoice from the dealer and pushes the asset against him has no direct relationship with the buyer. Agent exclusively believes the data provided by the dealer. As a result, the relationship between merchants and buyers is not really directly to the lender, and in this way exposes the financiers to significant harm from unpaid invoices as agreed or disputed.

What is Invoicing Financing?

Financing of custom receipts depends on the purchase invoice from the seller's financiers. As a result, financiers agree to advance the money to the dealer against each invoice. Buyers who purchase seller products must pay a special invoice to the investor.

How does the Invox Finance Platform solve the problem?

The Invox Finance platform is a decentralized peer-to-peer invoice loan platform that will allow sellers, buyers, investors, and other service providers to directly connect, interact, share and distribute information. The platform aims to create an environment of mutual trust by facilitating transparency between parties and satisfactory performance.

This platform will disrupt and revolutionize traditional invoice financing by implementing a system in which trust and transparency between all parties are developed through the rewards system it contains.

In addition, the implementation of transactions and the flow of information will not depend on a single centralized service provider, but rather governed by a set of transparent rules implemented on a fully distributed ledger.

Invox Finance Difference

- The platform is decentralized

- Direct access to investors

- The price is cheaper for the seller

- A new way for investors to diversify

Platform Overview

The description of the Invox Financial Platform consists of the following

- Dynamic Invoice Automatic Contract

- Darlehen Smart contract

- User access and processing center

- Bank API Integration

Why Should Invox Finance?

- Platform Decentralized Platform

- Lower Price for Seller

- Dynamic Invoice in Distributed Ledger

- Bringing All Parties together

Solution from INVOX FINANCE

Invox Finance is a decentralized platform for peer-to-peer loans. This platform enables a direct link between buyers, sellers and investors, which facilitates the sharing and distribution of information. This enhances the transparency of the lending process. In addition, in the Invox financial platform, all information flows and transactions are handled by a single service provider, which gains more confidence in the platform through the use of certain rules based on current market scenarios.

In conventional financing, the bill financier has bought the bill by the seller and the capital owner is now ready to give the seller the down payment for each bill, but the deadline is that the buyer must pay money directly to the owner of the capital bill. Such scenes create a trust issue between all parties involved in the transaction.

The following is a feature that distinguishes Invox financial platform from traditional invoice financing system.The seller will be able to receive money from investors with low interest rates.

New channels for investors will be opened, which will help them to trade in the industrial sector.

The Invox Financial platform is a fully decentralized platform where all parties connect and create transparency in their information and transactions.

Sellers can gain direct access to investors with a peer-to-peer credit environment that will benefit both sellers and investors.

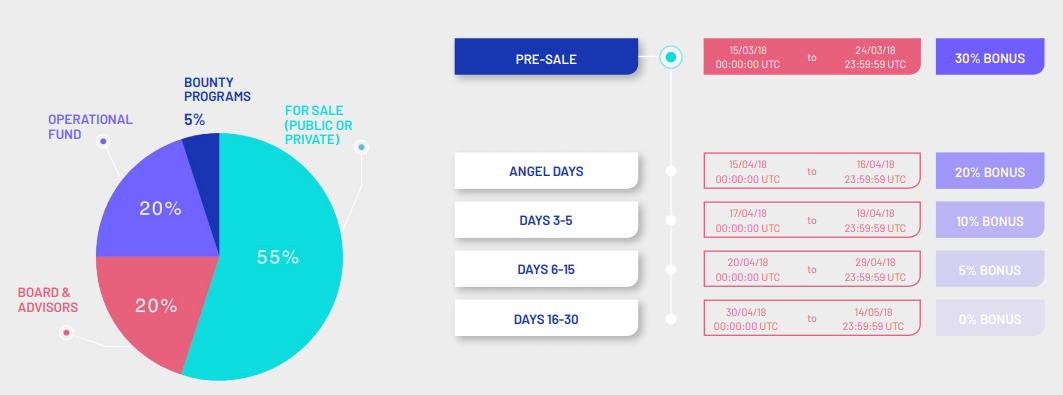

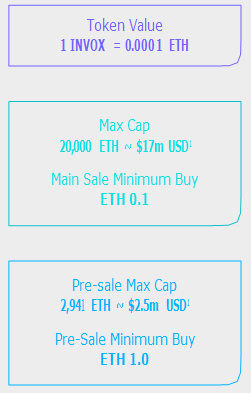

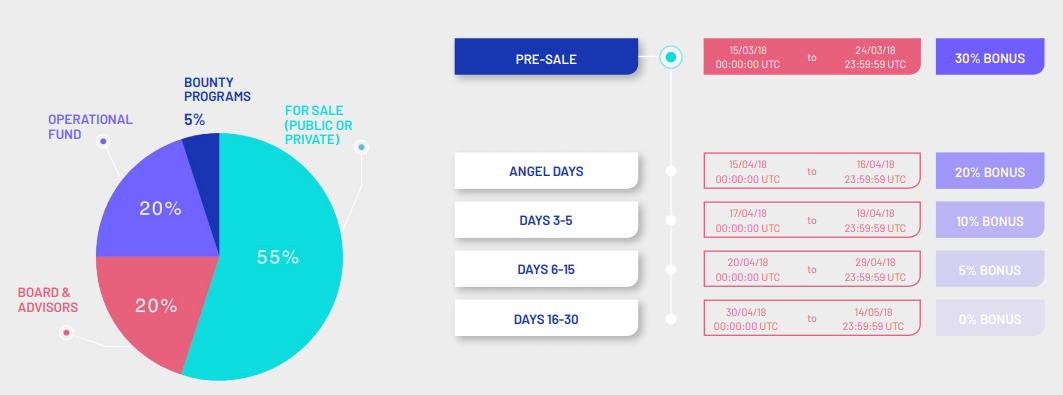

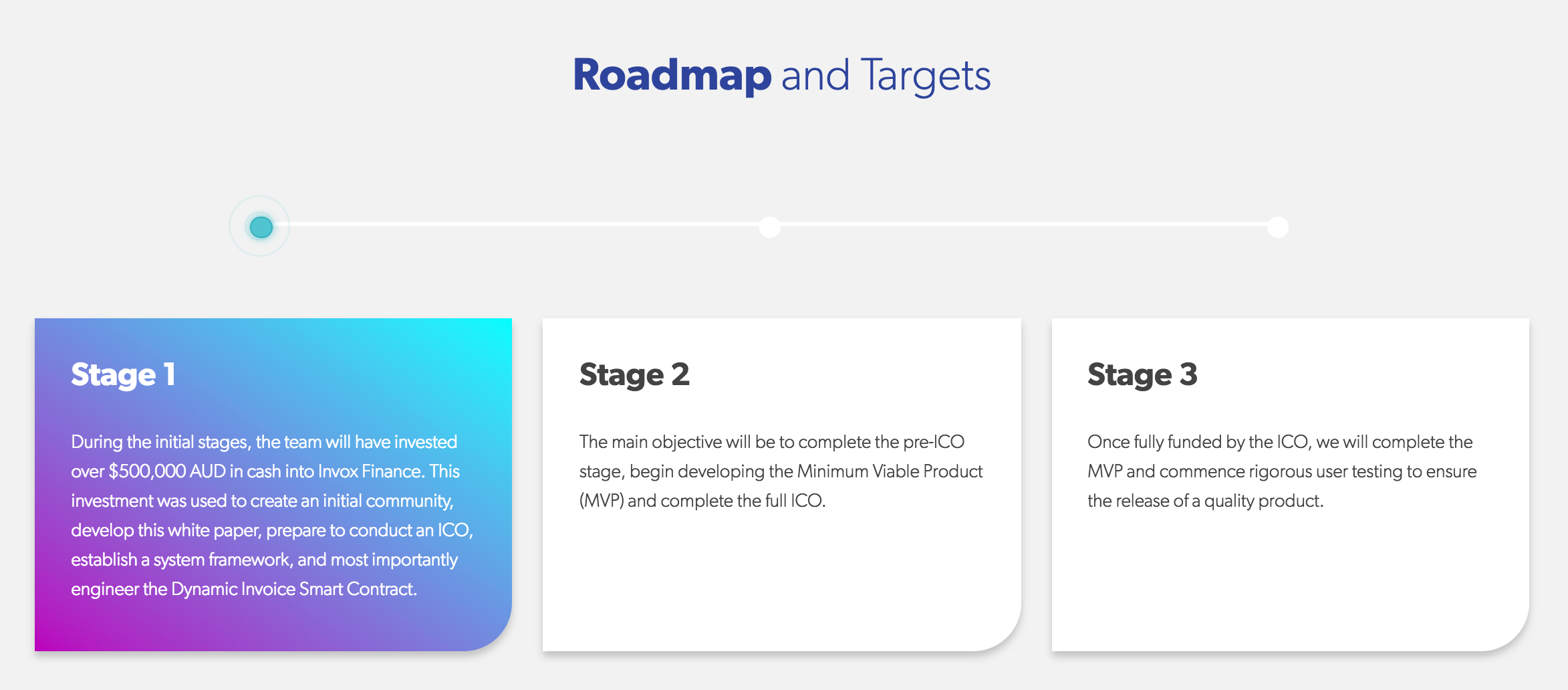

The reason behind doing ICO is to pre-sell membership to the system through the sale of Invox Tokens. Although the seller may obtain middle or upper level membership through the purchase of an Invox Token or obtain them through a reward for verification and invoice payment, initially all sellers must purchase an Invox Token (either in ICO with

discount rates or from the Invox Finance Platform) to be able to pay their annual membership and access the Invox Finance Platform. For this reason, there should be an initial token inventory when the Invox Finance Platform is introduced.

The final number of printed Invox Token will be released on our website at www.invoxfinance.io. The founder and advisory team will be allocated a portion of the Invox Token, which will be locked in escrow. This amount will be calculated by multiplying the number of tokens sold by

0.20. Invox Tokens will also be set aside for operational funds. This amount will be calculated by multiplying the amount sold

token of 0.20. In addition, there will be an Invox Token set aside for reward programs and airdrops. This amount will be calculated by multiplying the number of tokens sold by 0.05. All Invox Tokens will

made at one time, after the conclusion of ICO

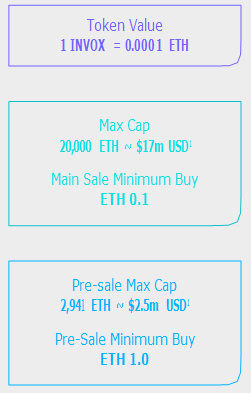

The maximum possible inventory amount for Invox Tokens is 464,000,000. This is based on possible maximum bonus rate, maximum allocation (as listed above) and token conversion of 1ETH = 10,000 INVOX. It should be noted that the average bonus rate across ICO will be lower than the maximum possible bonus rate. For this reason the total supply is likely to be lower.

Token Allocation & Token Sales Structure

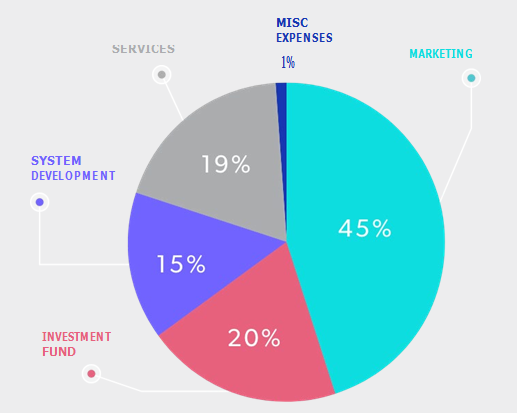

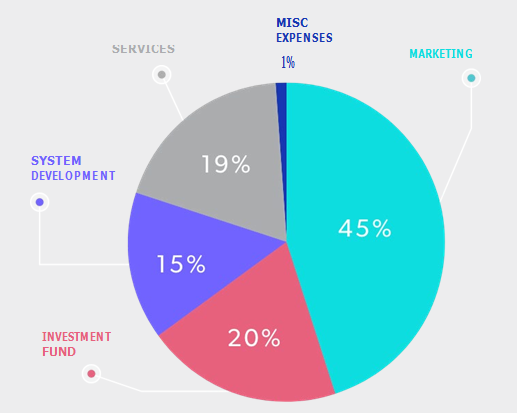

Fund Details

Invox ICO

discount rates or from the Invox Finance Platform) to be able to pay their annual membership and access the Invox Finance Platform. For this reason, there should be an initial token inventory when the Invox Finance Platform is introduced.

The final number of printed Invox Token will be released on our website at www.invoxfinance.io. The founder and advisory team will be allocated a portion of the Invox Token, which will be locked in escrow. This amount will be calculated by multiplying the number of tokens sold by

0.20. Invox Tokens will also be set aside for operational funds. This amount will be calculated by multiplying the amount sold

token of 0.20. In addition, there will be an Invox Token set aside for reward programs and airdrops. This amount will be calculated by multiplying the number of tokens sold by 0.05. All Invox Tokens will

made at one time, after the conclusion of ICO

The maximum possible inventory amount for Invox Tokens is 464,000,000. This is based on possible maximum bonus rate, maximum allocation (as listed above) and token conversion of 1ETH = 10,000 INVOX. It should be noted that the average bonus rate across ICO will be lower than the maximum possible bonus rate. For this reason the total supply is likely to be lower.

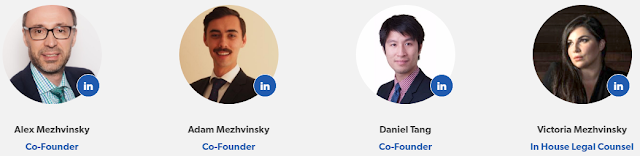

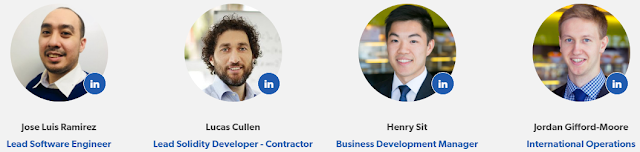

TEAM

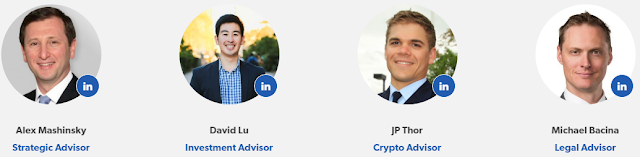

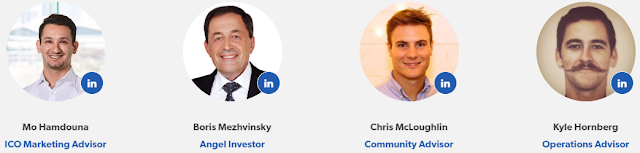

ADVISER

FOR MORE INFORMATION:

Whitepaper: https://www.invoxfinance.io/docs/Invox-Whitepaper.pdf

ANN Thread: https://bitcointalk.org/index.php?topic=3048498.0

Bounty Thread: https://bitcointalk.org/index.php?topic=3063980.0

Facebook: https://www.facebook.com/Invox-Finance-162381191061327/

Twitter: https://twitter.com/InvoxFinance

Telegram: https://t.me/InvoxFinanceCommunity

By:betawiarab

0x4018Fc326AfaAAf47f5042794AaaB13Ac1cd5A05

Tidak ada komentar:

Posting Komentar